gorodenkoff/iStock by means of Getty Illustrations or photos

For the thirty day period of February, hedge money outpaced the efficiency of key indices, soaring .3%, in accordance to the PivotalPath Composite Index, whilst the S&P 500 dropped 3.% and the Nasdaq slid 3.4% in the very same month.

Preqin is looking at powerful hedge fund returns as very well. Its All-Methods Hedge Fund benchmark returned 3.43% in February, setting up on January’s 2.03% obtain and bringing the 12-month return to just about 26%.

The composite 12-month beta to the S&P by way of February was .16, info service provider PivotalPath reported.

By strategy, managed futures and world-wide macro led all methods in February, making 2.2% and 1.3% respectively. The fairness sector turned in the worst functionality, largely from losses in the technological innovation, media, and telecom and health care sub-techniques.

More compact resources appeared to have an edge on bigger cash past month, with the $500M-$1B AUM corporations clocking in the finest gains, up .45%. Cash with extra than $5B in AUM slipped .8% in the similar thirty day period.

The price-around-expansion change continued to acquire traction in February, with the PivotalPath proprietary Cyclical Sectors Basket outperforming the Expansion Sector Basket by 4.2%.

“Multi-method, Managed Futures, Global Macro, and Credit history ended up good for the month and carry on to crank out prime of class alpha,” the agency claimed. “Commodities, especially oil, attained clean highs not witnessed in a decade which, along with continued volatility, benefited World-wide Macro and Managed Futures funds who caught the correct side of the trade.”

In addition, the hedge fund area has been attracting much more gamers. Quant systems company SigTech explained new fund launches stay strong, with nearly 2,000 new funds for each yr, on normal, due to the fact 2019. Of the 5,500 new hedge funds began due to the fact 2019, 70% are centered in the U.S., 9% in the U.K. and 5.2% in China.

“The sturdy amount of new hedge fund launches demonstrates a sustained solid need from buyers for modern and uncorrelated expense techniques to meet up with return anticipations in an progressively tough market place natural environment,” explained Daniel Leveau, vice president, Trader Answers, at SigTech.

Crypto is gaining traction as a hedge fund approach. In 2021, some 171 crypto hedge funds have been launched bringing the strategy’s complete to 774. Of people, 80% are domiciled in the U.S.

Note that some a lot more standard financial investment companies are forming corporations that give buyers access to hedge-fund-like procedures. Scenario in place: Fidelity Financial investment has commenced a liquid options device.

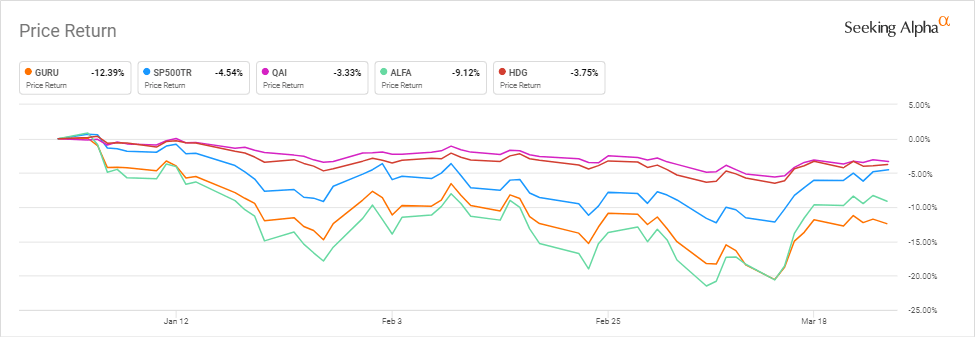

Take a seem at the YTD performance of ETFs intended to mimic hedge-fund effectiveness: Guru, ALFA, QAI, HDG.