Client organizations wanting to go general public in 2021 are probable to enter a bustling IPO marketplace, gurus say, pursuing the investing debuts of far more companies in the sector during 2020 than any of the earlier 5 a long time.

Airbnb Inc., DoorDash Inc. and some others assisted make 2020 a brisk yr for IPOs as community valuations defied the coronavirus-driven hit to the overall economy. Buoyed by hope the pandemic could be ending soon, Biden’s election to the White Household and lower curiosity premiums, trader enthusiasm soared in 2020. That enthusiasm served travel up public valuations that designed it much less expensive to raise cash on the public market place when compared to the non-public one, authorities say.

“You do not want to sit on the sideline and miss out,” Robert Lambert, an investment strategist with Strategic Prosperity Partners, reported in an job interview. “Far more businesses are just hurrying to choose advantage of a crimson-sizzling industry.”

Maplebear Inc., which does business as Instacart, Poshmark Inc. and other corporations that have filed for IPOs but have nonetheless to debut could be amongst these that pick to go community in 2021. The large valuations of Airbnb, DoorDash and other folks adhering to their buying and selling debuts contributed to a snowball result that served drive a lot more private companies to test to go public, Lambert explained.

Browse A lot more: Indication up for our weekly coronavirus e-newsletter here, and go through our latest coverage on the disaster right here.

“We’re in one particular of those people increase periods,” James Angel, a Georgetown College professor of finance, claimed in an interview. “Correct now general public markets are stating, ‘Hey, we have bought the funds — arrive and get it.'”

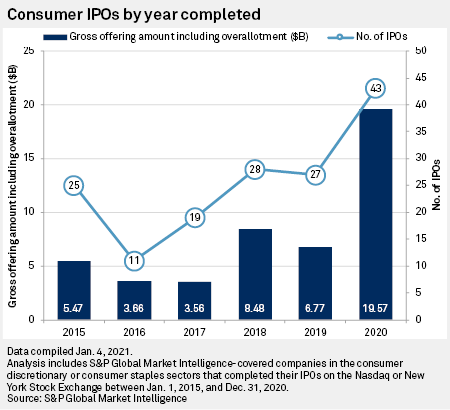

A record range of purchaser providers obtained the information: 43 completed IPOs on important U.S. exchanges in 2020, very well outpacing single-12 months totals from the prior 5 several years, according to S&P International Industry Intelligence.

Dashing for it

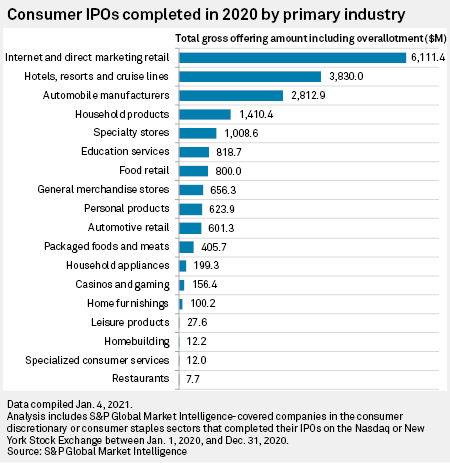

Client providers lifted a mixed $19.57 billion in proceeds by IPOs on the New York Inventory Trade and Nasdaq, in accordance to Current market Intelligence. Amongst people, world wide web and direct advertising and marketing retail organizations like DoorDash and ContextLogic Inc. raised a combined $6.11 billion, a lot more than any other market in the sector. ContextLogic is the mother or father firm of Wish, an e-commerce system that connects merchants and buyers. ContextLogic and DoorDash both of those declined to remark thanks to SEC quiet period of time limits.

There are inclined to be far more IPO issuances when public valuation multiples exceed private valuation multiples, Chris Malik, a controlling director at KeyBanc Cash Markets, explained in an electronic mail. In 2021, the basic trends will at first be the similar: Institutional and retail buyers will appear to put funds to work in a lower-desire-price environment, and traders will continue to appear for advancement stories or corporations they are common with, Malik mentioned. All this will on stability aid organizations that reward from the work-from-household development or are targeted on resolving the latest health care disaster, Malik said.

“Provided sturdy community equity valuations and volatility that is trending lower, I assume fairness issuance to continue via the end of the very first quarter and maybe outside of,” Malik claimed.

Instacart, Poshmark and Bumble Buying and selling Inc. are amid the most expected customer-experiencing IPOs of 2021, while these businesses have a tech spin, which will possible be the much larger sector driver, Christina Roupas, co-chair of the Capital Markets Follow at Winston & Strawn, said in an email.

“Consumer-going through firms tend to have far more model recognition and attractiveness to retail investors, which may perhaps push industry pleasure close to IPOs,” Roupas explained. “Nonetheless, retail traders ordinarily comprise only a incredibly compact percentage of IPO purchasers.”

Instacart, a grocery shipping and delivery and select-up support, is reportedly doing the job with Goldman Sachs Team Inc. to direct its IPO designs. Maplebear and Goldman Sachs declined to remark. The on the net browsing web-site Poshmark submitted Dec. 17, 2020, for an IPO and declined to remark to Market place Intelligence, citing a peaceful period essential by regulators. Bumble operates the Bumble dating app and is reportedly scheduling to go general public in February. Bumble did not react to a press inquiry.

Bark & Co, the operator of the Barkbox membership support for pet dogs, designs to go public by means of a merger with a exclusive function acquisition corporation. Bark & Co. declined to comment. Cole Haan LLC confidentially submitted for its IPO in Oct 2019, and the U.S. shoe and attire business created its strategies community in February 2020. Cole Haan did not respond to a press inquiry.

Exterior the client sector, Coinbase Worldwide Inc., a cryptocurrency vendor, confidentially submitted for an IPO on Dec. 17, 2020, although the inventory trading platform Robinhood Markets Inc. is reportedly checking out a current market debut. Robinhood declined to comment and Coinbase did not react to a push inquiry.

Pausing for thought

Prior to the IPO current market heated up in 2020, the onset of the pandemic and sinking oil markets cast uncertainty above just how numerous organizations would go community final yr.

A stable equity market place that is buying and selling neutral-to-favourable is vital when promoting an IPO, Malik stated. IPO action amplified in 2020 the moment volatility commenced to subside and equities traded up noticeably in the latter fifty percent of 2020, he mentioned.

“As soon as the IPO window re-opened following the original COVID shutdown, traders have been hungry for IPOs that they considered could endure (and even prosper) in a put up-pandemic entire world,” Roupas of Winston & Strawn claimed. “This points out the superior quantity of healthcare and tech IPOs in 2020.”

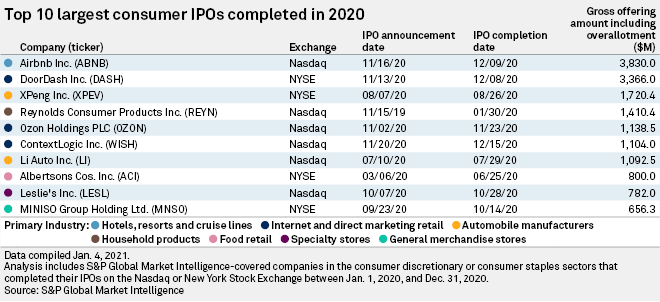

Airbnb and DoorDash had the largest and buzziest IPOs between client companies. Airbnb lifted $3.83 billion from its public debut on Nasdaq on Dec. 10, 2020, and DoorDash raised $3.37 billion right after its shares commenced investing on the NYSE on Dec. 9, 2020. The pandemic has strike the two corporations in opposite approaches: Airbnb bookings dropped by more than a 3rd in the initially 9 months of 2019, though DoorDash is attaining from a increase in on the net foodstuff shipping and delivery as eating places continue on to function below tight limits aimed at curbing bacterial infections.

The digital loan provider Affirm Holdings Inc. and Roblox Corp., an on line gaming platform, reportedly delayed plans for independent December IPOs immediately after shares of Airbnb and DoorDash popped on their initial days of trading. The delays by Affirm and Roblox were being reportedly carried out so the corporations could perhaps sell a lot more shares. Roblox and Affirm declined to comment.

Amongst the other higher-value IPOs in the sector in the course of 2020 ended up China-dependent electric-vehicle makers XPeng Inc., which lifted $1.72 billion in its Aug. 26, 2020, debut, and Li Vehicle Inc., which posted $1.09 billion from its July 29, 2020, featuring. Earlier in the yr, Reynolds Purchaser Items Inc., the enterprise driving Reynolds Wrap and Significant trash bags, elevated $1.41 billion in its Jan. 30, 2020, IPO. The businesses did not respond to requests for comment from Market place Intelligence.

Onward and upward

Authorities anticipate IPO activity to carry on apace in 2021, however some valuations could tumble supplied they are by now so high.

“Providers are coming to market place with valuations like we’ve by no means seen,” Lambert reported. “I do not see a lot room for enlargement.”

Two other aspects could enable press much more privately held businesses into general public marketplaces in 2021: The SEC on Dec. 22, 2020, gave closing approval to a strategy to enable immediate listings, an different to classic IPOs. And a lot more than 200 SPACs that went public in 2020 will be hunting for discounts in the new 12 months, Jay Ritter, a University of Florida professor of finance, reported in an job interview.

“As very long as inventory markets remain up or go on to maximize even even more, I think there will be a continued circulation of non-public businesses into the public room,” Ritter explained. “In 2021, we could see not only standard IPOs but a ton of private businesses getting into the public sector through merging with a SPAC.”