Other options also shaky. Central banking institutions leery of Chinese RMB, its share continue to irrelevant. Euro’s share is trapped. But the yen’s share has been increasing.

By Wolf Richter for WOLF Street.

The US dollar’s posture as the dominant global reserve currency is an immensely crucial issue in supporting the ballooning US governing administration financial debt, the Fed’s drunken money-printing, and Company America’s ambition to offshore output to low-priced international locations, therefore building massive and at any time-expanding trade deficits. They all have develop into dependent on the willingness of other central banking companies to maintain significant amounts of dollar-denominated paper. But from the seems of matters, these central banking companies might be getting a minimal anxious.

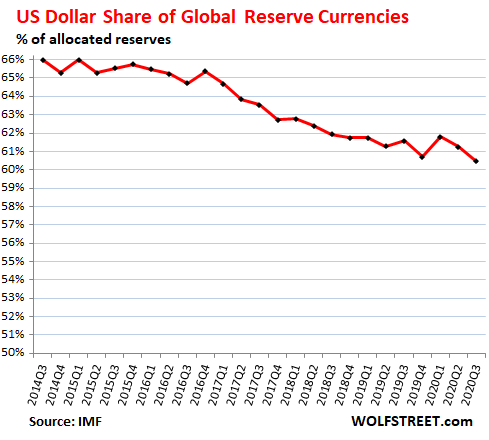

The international share of US-dollar-denominated trade reserves – US Treasury securities, US company bonds, US house loan-backed securities, etcetera. held by foreign central financial institutions – fell to 60.5% in the 3rd quarter, according to the IMF’s COFER data release. This is the least expensive because 1995. More than the earlier six many years, the dollar’s share has been dropping at a fee of about 1 proportion level for every year:

The dollar’s 20-yr decline.

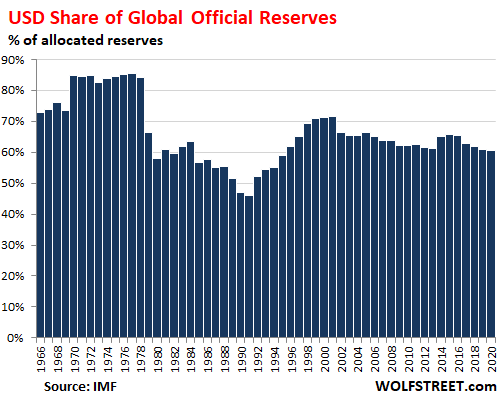

Greenback-denominated international international trade reserves do not incorporate the Fed’s very own holdings of greenback-denominated belongings that it acquired as portion of its QE, such as its $4.6 trillion in US Treasury securities and $2.1 trillion in US home finance loan-backed securities.

The drop in the dollar’s share commenced 20 several years back when the euro assumed the position of the predecessor currencies, like the Deutsche mark, that applied to be in the basket of overseas exchange reserves. But that 20-yr 10-share-issue decrease pales in contrast to the close to 40-position plunge in the dollar’s share from 1977 (85%) to 1991 (46%), which was followed by the 25-stage surge till 2000.

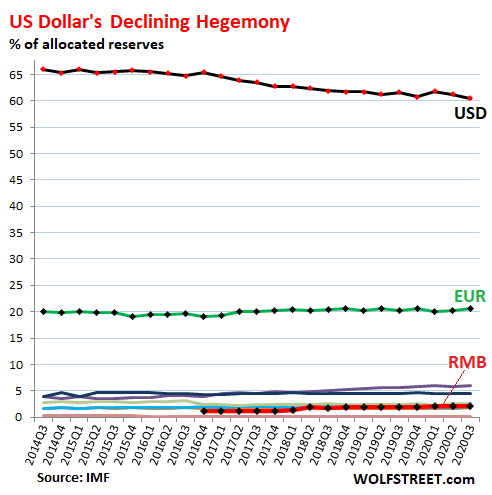

For now, the motto between these central banking companies, jointly, looks to be: simple does it. No a person wishes to bring about a sudden crisis (2020 = Q3):

The euro trapped at a 20% share. Desires of “dollar parity” put on keep until further observe.

The blended nations of the Eurozone have experienced a big trade surplus with the relaxation of the entire world, and notably with the US. Their currencies were being already reserve currencies. So at any time because the euro became an formal forex, and with its members increasing from at first 5 to now 19, there was communicate about the euro eventually reaching “parity” with the dollar as a reserve forex. But the Euro Credit card debt Disaster set an stop to that talk when euro-denominated sovereign personal debt, issued by Greece, defaulted.

The euro’s share has since been trapped in the selection in between 19.5% and 20.6%, however the Eurozone now contains 19 member states. In the third quarter, the euro’s share was 20.5%. The euro was the previous work by a solitary forex to dethrone the dollar.

The Chinese renminbi even now doesn’t depend.

The RMB grew to become an formal reserve currency in Oct 2016, when the IMF integrated it in its basket of currencies that again the Exclusive Drawing Rights (SDRs). There has been talk that it would be the next currency to dethrone the dollar. But by the seems to be of it, this will need a lot more persistence than mortals are expected to have.

Immediately after 4 decades of getting in the SDR basket, the RMB’s share in Q3 was however just 2.13%. But, but, but… it has edged earlier the Swiss franc (.17%), the Australian greenback (1.73%), and the Canadian dollar (2.%).

If the share of the RMB carries on to increase at the tempo of the past two a long time, it will just take 110 a long time for it to achieve 20%. At this rate, it is not heading to be a menace to the greenback in the anticipated life time of the normal Gen Z member. But items shift little by little until abruptly they shift fast and we can’t draw a straight line for 110 a long time. The RMB is the short purple line in the spaghetti near the really bottom (more on that spaghetti in a moment):

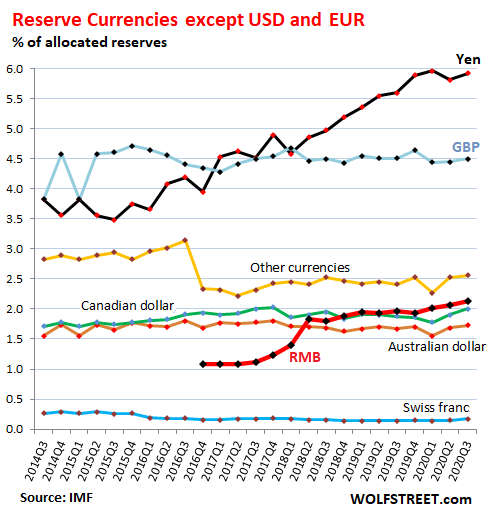

The increase of the Japanese yen.

To glance at the spaghetti at the base in the chart over, we have to pull out our magnifying glass, and the chart underneath does that. What sticks out is the increase of the yen, now at a share of just about 6%, up from 3.5% in 2015, far outpacing the rise of the RMB. This has produced the yen the third most significant reserve forex.

Japan is fiscally in the worst condition of any region in this group, or of any big country and Japan has also been the most relentless funds printer of any big place. But it usually tends to have a big trade surplus with the relaxation of the planet, and faith in the yen, including by the Japanese themselves, has remained unshaken.

The share of the pound sterling (GBP) has remained approximately flat at 4.5%, irrespective of the Brexit chaos considering the fact that 2016, earning it the fourth major reserve forex.

The Eurozone and Japan – with the #2 and #3 reserve currencies – commonly have substantial trade surpluses with the rest of the earth. This exhibits that the economic climate of a main reserve forex does not need to have a trade deficit. The US did not have persistent trade deficits right up until the early 1990s. There were being decades in advance of then when it even had a trade surplus. The persistent trade deficits did not acquire off right until the mid-1990s and exploded from there on amid the rampant “globalization” of Company The united states. The dollar getting by much the greatest reserve forex has enabled the US to conveniently finance its significant trade deficits, which permits the US to even have those significant trade deficits.

If the dollar’s standing as top rated-canine world reserve currency deteriorates a total ton, it would shake up that equation. At the speed of drop of the past 6 many years, it would take a ten years for the dollar’s share to drop to 50%, with other currencies choosing up the slack. But for the equation to be shaken up, the dollar’s share would most likely have to fall very well down below 50%.

“Easy does it” is however the motto with reserve currencies. And it performs until finally quickly, for whatever motive, things go off the rails. But right up until one thing does go off the rails, the movements are sluggish and continuous and span many years.

An more and more vital question, because an individual often has to get this personal debt – and it is not just the Fed. But the share of overseas holders is waning. Read… Who Acquired the Monstrous $4.2 Trillion Included to the Extremely Spiking US Countrywide Debt in 12 Months? Everyone but China

Appreciate studying WOLF Avenue and want to support it? Applying advert blockers – I entirely get why – but want to support the web-site? You can donate. I recognize it immensely. Click on on the beer and iced-tea mug to come across out how:

Would you like to be notified by means of electronic mail when WOLF Road publishes a new post? Sign up listed here.

![]()