It’s the time of yr to search back again in excess of the past 12 months, but a single strategist achieved again to the 19th century to explain what’s going on.

In 1898, Swedish economist Knut Wicksell mentioned equilibrium was only attained if the marginal return on capital is the same as the charge of revenue, notes Kit Juckes, the London-primarily based head of forex strategy for French lender Société Générale. (Here’s a wonderful summary of Wicksell’s views, from the St. Louis Federal Reserve.)

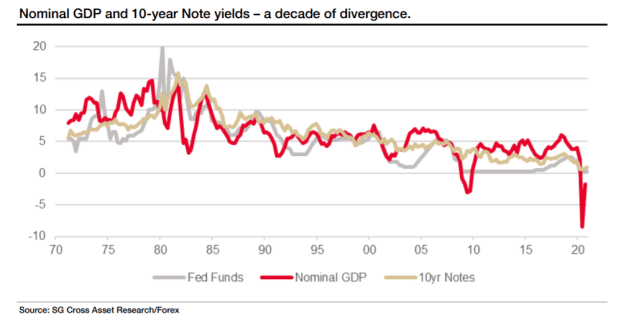

Rapidly-ahead a bit, and Juckes factors out that the generate on the U.S. 10-year Treasury has averaged 6.2% above the last 50 decades. For the duration of that time interval, nominal gross domestic merchandise progress (true GDP growth furthermore inflation), also has averaged 6.2%.

That is, of study course, a much cry from current conditions, exactly where the 10-year generate can not break 1%, and the financial system has been contracting about the previous 12 months. And even more than the final 10 years, 10-year yields have been trailing GDP development.

Juckes just about summarizes what has took place. “Central banks used the 1980s obtaining inflation below command, but the 1990s saw the emergence of downward strain on CPI [consumer price index] inflation in particular, from a variety of sources: child boomers entered the labor power, the Soviet Union’s collapse massively boosted Europe’s labor power, China’s entry into the globe economy transformed supply of a host of merchandise, technology experienced a identical impact and for fantastic evaluate, labor unions grew to become far much less highly effective,” he writes.

Soon after the 2008-09 economical disaster and in the course of the COVID-19 pandemic, “interest premiums are glued to the floor.” But even as inflation is under control, Juckes says it is obvious economies aren’t in equilibrium, as small desire fees have sent “asset charges into orbit. And whilst that is lovely for these who possess property, it raises inequality, fuels political division between asset-abundant and asset-poor, and leaves the Fed hostage to equity markets because they can’t pay for to set off a correction in indices that would mail the U.S. economy again into recession. That provides marketplaces much too substantially electric power above policy,” he claims.

The future level hike cycle will peak even decrease than the last one particular — the productive Fed funds level was 2.4% in 2019 — “because fairness valuations will make it so.” Juckes suggests this disequilibrium will go away the world-wide economic system fragile and prone to an additional crisis.

The excitement

Pharmaceutical AstraZeneca

AZN,

on Wednesday claimed the coronavirus vaccine it has produced with the College of Oxford has been authorised by the U.K. govt. The U.S., meanwhile, claimed the U.K. pressure that spreads far more immediately has been identified in Colorado. Hospitalizations reached a day by day report of 124,686 on Tuesday, in accordance to the COVID-19 tracking job, as California prolonged its lockdown.

Congressman-elect Luke Letlow, a Louisiana Republican, has died at age 41 from coronavirus.

The fate of both of those the $2,000-per-human being stimulus verify, as perfectly as the protection bill previously vetoed by President Donald Trump, is nevertheless in dilemma in the U.S. Senate. Analysts hope the higher chamber to kill the added stimulus-check out laws accepted in the Residence, but the proposal has received assistance from a handful of Republicans even as Greater part Leader Mitch McConnell has blocked a vote.

With polls extremely shut on the important Senate races in Georgia, President-elect Joe Biden and Vice President-elect Kamala Harris will individually travel to the Peach State to marketing campaign for the two seats, the Biden press place of work explained. Democrats would consider control of the Senate if they gain the two elections.

The U.K. Parliament is anticipated to easily distinct the trade arrangement achieved with the European Union.

The marketplaces

Following the S&P 500

SPX,

and Nasdaq Composite

COMP,

fell all the way to the second-highest stage in historical past, U.S. inventory futures

ES00,

NQ00,

were being once more pointing upward.

The U.S. greenback

DXY,

fell. The yield on the 10-year Treasury

TMUBMUSD10Y,

was .95%. Bitcoin

BTCUSD,

rose as higher as $28,752, a clean record, according to CoinDesk data.

The tweet

There was a good deal of dialogue on social media about this CNBC job interview with Interactive Brokers

IBKR,

chairman Thomas Peterffy, wherever he mentioned for the first time in its historical past, its consumers were being web small out-of-the-cash inventory choices. “It’s usually about Tesla

TSLA,

and Amazon

AMZN,

and Apple

AAPL,

— that’s exactly where most of the action appears to be to be. So the Robinhood individuals are extended these options and Interactive buyers are short these selections,” reported Peterffy. Robinhood is the brokerage that quite a few youthful investors trade on.

Random reads

A Greek nurse erected his have intensive care device after not liking the remedy possibilities accessible when his wife, her mother and father and her brother bought COVID-19.

Archives reveal a comedian’s prank simply call to examination out an impersonation may well have saved the governing administration of previous U.K. Primary Minister John Big.

Have to have to Know commences early and is updated right up until the opening bell, but sign up here to get it delivered after to your e-mail box. The emailed version will be despatched out at about 7:30 a.m. Japanese.

Want a lot more for the day in advance? Indication up for The Barron’s Day-to-day, a early morning briefing for investors, such as distinctive commentary from Barron’s and MarketWatch writers.