BitCoin and electronic currencies are considered way too dangerous for most traders. Even so, the earlier risks had been about legality, integrity of the repositories and illicit use. These are fading now and for superior-threat oriented investors, two stocks are appearing as buys in the modern BitCoin industry correction: MicroStrategy Included (NASDAQ:MSTR) and Sq., Inc. (NASDAQ:SQ).

Q1 2021 hedge fund letters, conferences and more

Worthless Token

Currency is a worthless token that we concur to use to facilitate transactions, to retail store worth and as a unit of account. Variations in acquiring electrical power among currencies are reflected in the exchange prices and the international trade sector has been a popular spot for traders for a long time and even far more not too long ago. When cash market steadiness grew to become the aim of global central banking institutions following the fiscal disaster forex trade markets have been the only sport in city for traders.

Northern Pipe Line Wasn’t Graham’s Only Activist Scenario

We wrote about Ben Graham’s activism at northern pipe line, but there are other interesting tales involving the father of benefit investing Price investing and activism go hand-in-hand. Benjamin Graham, the godfather of worth investing, identified how critical it is to include activism into a value strategy somewhat early in his profession, a tactic that Browse More

We wrote about Ben Graham’s activism at northern pipe line, but there are other interesting tales involving the father of benefit investing Price investing and activism go hand-in-hand. Benjamin Graham, the godfather of worth investing, identified how critical it is to include activism into a value strategy somewhat early in his profession, a tactic that Browse More

Absent Electronic

The major video game these days has been digital currencies. Electronic currency trade rates stay incredibly volatile and as a result they fall short to give the functions of a “currency”. Their early attractiveness was the secrecy of the transaction. But authorities are all above your digital currency transactions now. With the secrecy attribute diminishing digital currencies are less practical in transactions.

Like all currencies, there is incredible benefit to the issuer. The token is worthless but you can acquire stuff with it which brings on the mentality of “let’s get as quite a few tokens out as possible”. The issue is men and women should concur to settle for them on demand. When it will come to the dollar, very well, the wool is entirely more than our eyes as trillions and trillions of tokens are issued and we happily take it.

Price Proposition

To try to make electronic currencies a lot more suitable and slow their issuance BitCoin appeared with the foolish proposition that if we squander a lot of electrical power and personal computer electricity to make the token the “it will have value”.

A a lot a lot more attention-grabbing early function of bitcoin was a cap on the range of tokens that can be developed. We will ultimately have a currency with a preset variety of tokens. That is extremely exciting for a dollars theorist due to the fact no other currency has at any time experienced a fixed provide. But, in 2015 to 2018 when the trade price for bitcoin rose 9,500%, the value to the issuers (the bitcoin miners) grew to become so massive that the fixed range of tokens concept was abandoned and offer exploded. Other token versions appeared and the complete volume of tokens rose effectively further than any supposed fixed supply.

From 2017 to 2019 the greenback trade price for bitcoin (incorrectly known as the cost in the monetary media) trended down and fell 83%. The willingness to hold currency boosts as curiosity fees fall so when costs of return on currency equivalents (like a financial institution account) drop to zero so does the incentive to convert currency so at minimum part of the 1,600% progress in BitCoin given that 2019 has been a immediate consequence of the extremely-unfastened income procedures about federal government-managed currencies.

Electronic Currencies Stocks to get?

With the current sharp fall (42%) in the US greenback trade amount for bitcoin it is a good time to look for prospects. Two organizations appear in our most the latest update. Just one is attempting to make revenue with a leveraged buying and selling system and the other is generating revenue by extracting a brokerage distribute.

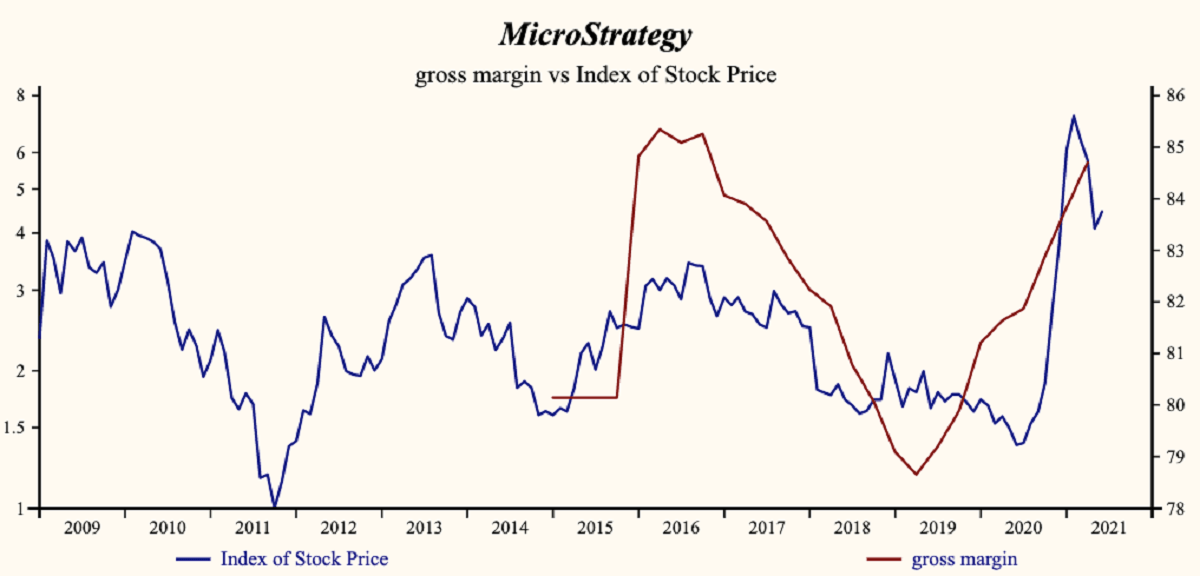

MicroStrategy (MSTR) is a tiny company software enterprise with $485 Million in product sales previous calendar year. More than the past three quarters the firm has expended $2,200 Million to invest in BitCoin. They financed the buy with the issuance of $1,500 Million in personal debt (convertible). Their prowess as a trader is drawn into problem just after they skipped the current drop-just one of the steepest drops in the dollar value of BitCoin in its background.

This is a fantastic significant-possibility decision for an trader who believes the in ever escalating greenback value of BitCoin. Evidence so considerably is that the firm does not intend to trade BitCoin. At the very least they skipped the most crucial providing opportunity considering that December 2017. Their reference to Bitcoin as a digital asset is preposterous. It is no more an asset than the buck in your wallet is. The current craze on Wall Road to explain BitCoin as an asset and even far more bizarre-electronic currencies as an asset-course is self-serving.

Substantial Threat Option

The organization has now booked a $190 Million decline on the placement and the shares are down 50% even though Bitcoin is down 42% (the MSTR fall is a modest decrease specified the MSTR leverage of the bitcoin position). This is your high-risk option and the shares can be expected to complete as perfectly as bitcoin and improved offered the leverage.

Lower Danger Choice

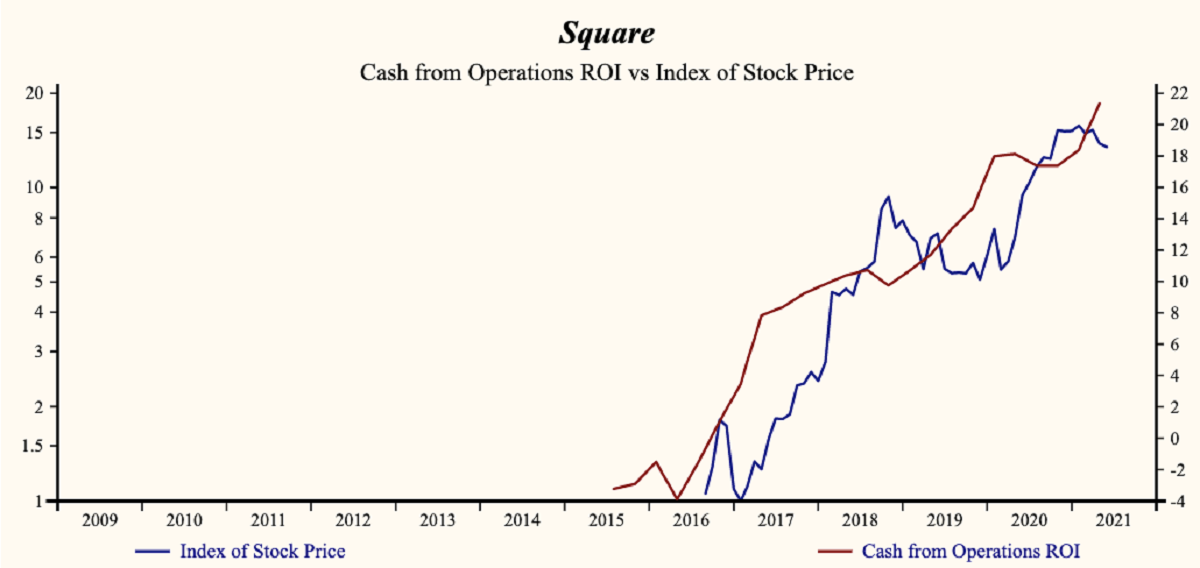

The other business that referenced electronic currencies in its money statements is Square (SQ). The enterprise is 10 moments even bigger than MSTR and BitCoin purchase is considerably scaled-down at $170 Million. This business has emerged as a broker in electronic currencies. You can now open up a electronic currency account (a wallet) sponsored by nicely financed general public corporation. The organization is acting as a broker. A broker (incredibly exceptional in fashionable times) buys the token and sells it into purchaser Wallets at a quality (the unfold is now about 8%). This is a substantially lower possibility business enterprise and results will be more a function of the quantity of trade than the greenback exchange price.

Square (SQ) is the improved selection for decrease possibility investors if the digital currency area continues to be unstable. Larger supporters will maintain the quantity of transactions and Square will make funds gathering a unfold on the climbing speculative quantity. If the bitcoin trade fee stabilizes and it gets to be far more valuable as a preferred currency to aid transactions, Sq. will make funds on the expanded transaction volume. Speculators can acquire MSTR. Higher possibility-oriented advancement traders should really buy SQ.

Are Digital Currencies Sustainable?

Digital currencies will not become broadly suitable till exchange fees are far more secure and that stability will make them substantially additional tedious for a trader. For the quantity of trade in bitcoin to move past speculation and into adoption as a forex it ought to come to be more steady. Reputable and steadiness will aid transactions. BitCoin is acknowledged a little bit much more broadly not long ago but still you can’t purchase a Tesla or in other terms functions as a retail store of value. Holders of bitcoin a short while ago have witnessed the value drop 42% as electronic currencies tried to be adopted as a world device of account. No firm direction nonetheless but they will fulfill stiff resistance from governments who are unwilling to give up the gain as a forex issuer).