peepo/E+ by way of Getty Photographs

Though the market would not want to touch any business investing for the potential, buyers ought to really start out loading up on the corporations established to lead the subsequent revolution. The key to such investing is getting organizations with loads of dollars on hand to continue investing during a economic downturn, and Joby Aviation (NYSE:JOBY) suits that invoice. My expenditure thesis remains Bullish on the stock below $5 as the 2024 electric vertical acquire-off and landing (eVTOL) start promptly methods.

Long term Is Approaching

The target of Joby Aviation is to make an eVTOL 100x quieter than a helicopter with 25% of the fees of a regular twin engine helicopter. Throw in safety advancements owing to several engines and the air taxi industry will take off from one particular not at the moment really feasible for most passengers.

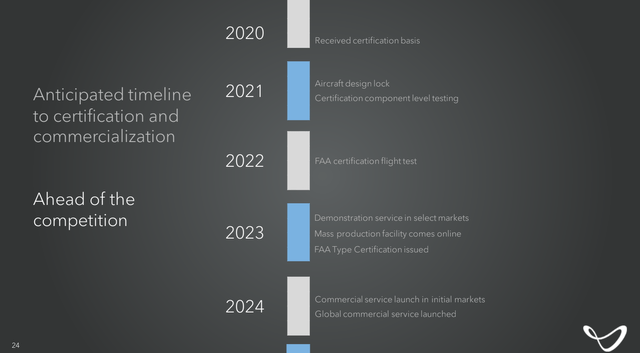

When Joby at first announced the SPAC offer with LinkedIn co-founder Reid Hastings and Zynga co-founder Mark Pincus again in early 2021, the corporation and other sector players predicted a timeline with 2024 as the commercial launch. The time period of time was stretched, but we’re now in the 2H of 2022 leaving ~2 many years until finally the anticipated start. The enterprise has now attained Component 135 Air Provider certification from the FAA in advance of agenda.

Joby Aviation SPAC presentation

In the inventory marketplace, a pair of many years can be an eternity. The the moment-promising market place has found stocks crushed because of to a looming recession and a decline of religion in SPAC offers.

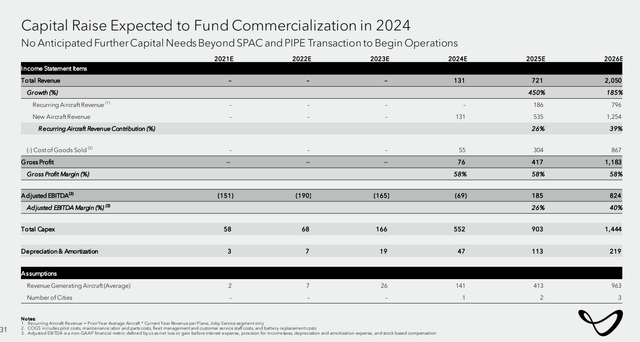

Now, traders need to have to start out returning to the guarantee of the eVTOL place. Joby forecast 2026 revenues topping $2 billion. The organization will crank out product sales from each marketing plane to other operators and operating an air taxi small business.

Joby Aviation SPAC presentation

The enterprise has two paths to a prosperous business business. Both business enterprise route promptly goes from restricted revenues in 2024 to ~$1 billion truly worth of revenues by 2026. As when the SPAC deal was declared, the current market will love the income progress the moment the company operations officially start and Joby Aviation goes from minimal revenues to multi-billions in just a pair of decades.

The dates may well get pushed out, but Joby Aviation is only likely to see a pull forward in desire when these aircraft are generated taking into consideration the ability to decrease expenditures and most importantly time for short journeys in congested cities.

The stock has a sector cap in the $3. billion assortment. The valuation won’t seem to be rationale with revenues not beginning until 2024 or 2025, but investors ended up the moment prepared to spend extra than double this valuation with virtually 4 several years prior to commercialization of the organization model.

Funds Is King

In purchase to arrive at the promising potential in eVTOLs and air taxis, a sector firm has to survive the hoopla interval and arrive at at the very least 2026. A whole lot of the eVTOLs predicted FAA certification in 2024 primary to a key ramp in manufacturing into 2026 in which income soar.

Because of to the enormous investments by Reinvent Technology Associates back in 2020, Joby Aviation continue to has a money stability of $1.2 billion. The enterprise is aggressively investing in the FAA certification procedure, take a look at flights and ramping up producing abilities in order to be operational in 2024.

In the March quarter, Joby Aviation burned $61.4 million in working activities and an additional $10.8 million on purchases of assets and devices. The corporation can undoubtedly cope with burning $72.4 million for each quarter with at minimum 3 a long time of hard cash on hand.

Considering that Joby Aviation was noticed as the chief in the sector and the very first to go public, the company raised considerably far more cash. Archer Aviation (ACHR) has a cash harmony of $704.2 million and Lilium (LILM) has $331. million.

The premier hard cash harmony or best income devote certainly does not guarantee achievement in this sector. The firm to 1st get hold of FAA certification, finish manufacturing and goal the right finish sector will be the most thriving. Contemplating the diverse suppliers are all concentrating on distinctive purposes for their eVTOLs, the competitors is not accurately direct amongst all of these companies.

Joby Aviation experienced the greatest backing and strongest balance sheet which improves the likelihood of good results. The sector shares have substantial dangers owing to the probable hold off of FAA certification top to an prolonged period of time of money burn up. The organizations may well be compelled to raise dollars in a tricky financial system or when the stock is beaten down leading to intensive dilution.

Takeaway

The vital trader takeaway is that Joby Aviation is considerably closer to plane certification now though the stock is down above 50%. The eVTOL company however has a prolonged path to producing aircraft and starting up an air taxi company, but the dangers are decreased each day that passes.

Joby Aviation remains a risky play with a lengthy period right up until plane certification, but the enterprise has targeted a potentially monster marketplace. Investors really should use the weakness to get started developing a placement for the extensive expression, but traders have to be geared up for a unstable couple of years wherever the inventory could continue to be out of favor.