To say that calendar year-more than-yr targeted traffic final results for Black Friday 7 days had been delicate would be an understatement. It was a pretty challenging couple of times for brick-and-mortar retailers. Nevertheless, wanting a tiny further and putting them into context together with some of Sensormatic Answers shopper study knowledge could possibly supply some welcome gentle as we journey to the end of the getaway website traffic tunnel.

To say that calendar year-more than-yr targeted traffic final results for Black Friday 7 days had been delicate would be an understatement. It was a pretty challenging couple of times for brick-and-mortar retailers. Nevertheless, wanting a tiny further and putting them into context together with some of Sensormatic Answers shopper study knowledge could possibly supply some welcome gentle as we journey to the end of the getaway website traffic tunnel.

Black Friday Weekend vs. Spring 2020

But initial, a very little modern heritage. The worst of the pandemic — the incredibly base of the retail targeted traffic journey — happened the week of April 12, 2020, when year-over-year visitors was down 83%. From the end of the spring into the summertime, site visitors designed a comeback by steadily rising from the -50%’s by way of the -30%’s. Right after Labor Working day, in-shop targeted traffic has continually flirted with -27% for each week correct up until eventually the 7 days before Thanksgiving.

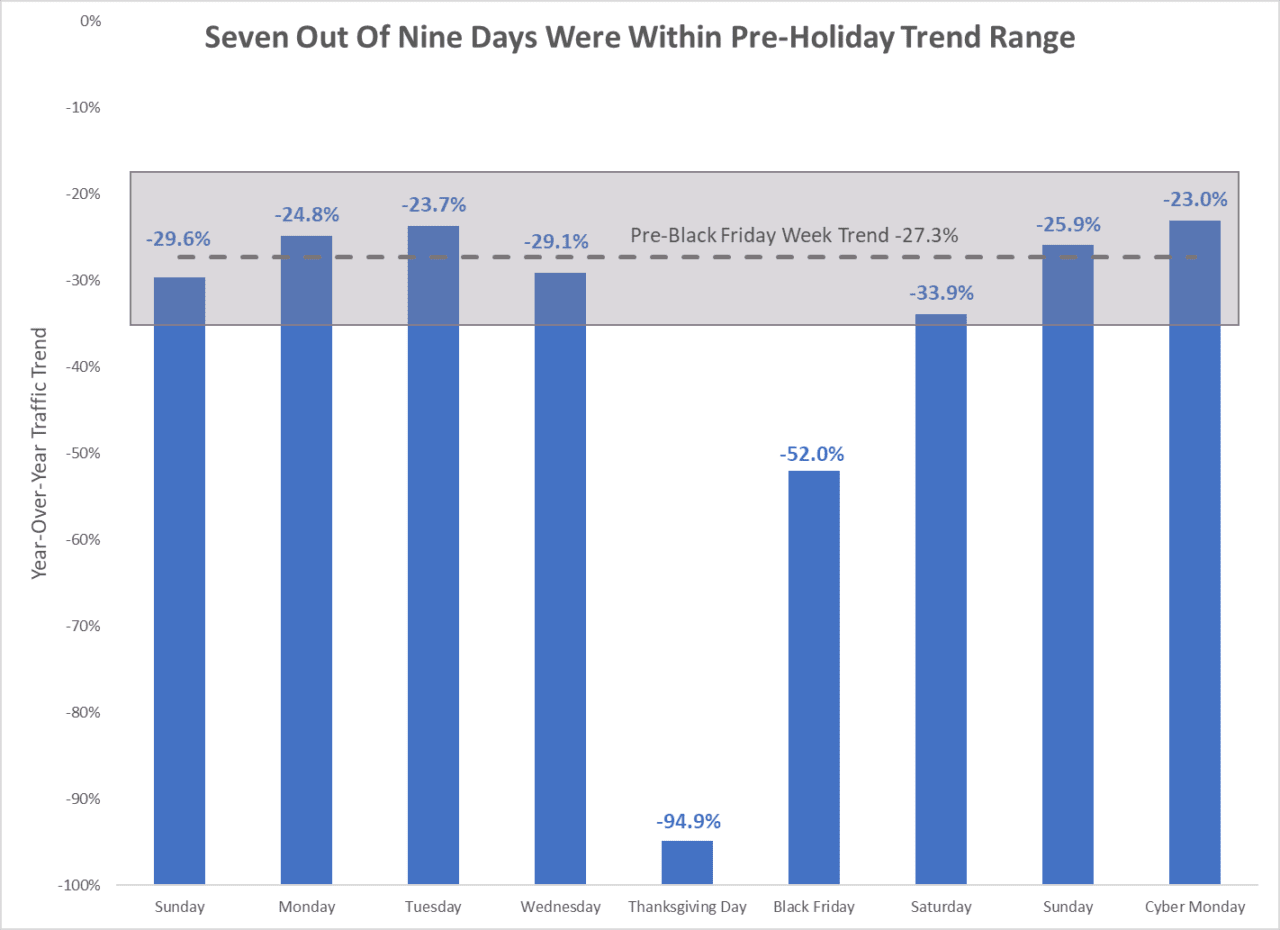

Sunday by means of Wednesday of Thanksgiving Week begun out constant with the current craze: averaging ideal all-around -27%. Nevertheless, shopper site visitors on Thanksgiving Day (Nov. 26) and Black Friday (Nov. 27) dropped noticeably in comparison to final year. Thanksgiving Working day was down- 95%, though Black Friday was down -52%. We saw continual advancement in excess of the weekend as Saturday (Nov. 28) and Sunday (Nov. 29) ended up nearer to recent traits, at -34% and -26% respectively. All round, the four days from Thanksgiving via Sunday ended up down -49% compared to 2019. Breaking from the trend was Cyber Monday (Nov. 30), which was only down -23%. That indicates 7 out of the nine times were inside variety of the pre-Black Friday 2020 craze.

Black Friday and Thanksgiving Lessons Learned: Buyers are Preventing Crowds

So how should we sense about these outcomes? Is the in-retail store season doomed this calendar year? I feel a small extra context is essential right before we determine to toss in the towel.

Let’s consider the uncomplicated one, to start with: Thanksgiving Day. Sure, retail pretty much lost all visitors from final yr. This was a specified taking into consideration most big stores and buying facilities resolved to remain closed this year to give some time back to their associates. It’s only due to the fact 2013 that Thanksgiving Working day procuring began to become an event, and judging from the actuality that it has only contributed 1.5% to 2.5% of the general six-7 days getaway shopper targeted traffic, it was not that a great deal of an event in the very first area. Shedding 95% of roughly 2% of targeted traffic is not that important in excess of the program of the overall holiday time, and could potentially be produced up later in the period (much more on that later on).

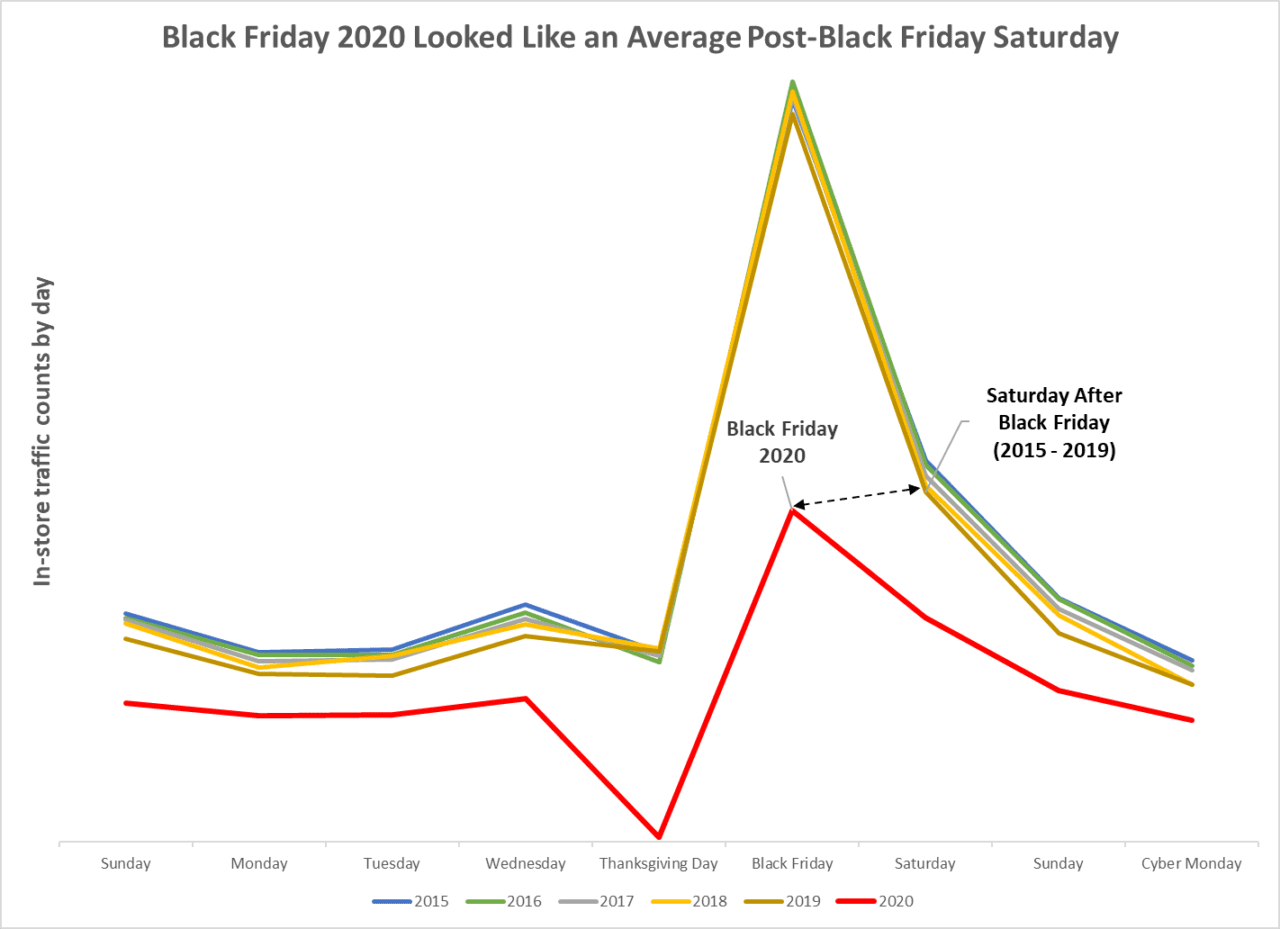

Black Friday, on the other hand, harm — with only 50 percent as a lot site visitors as in 2019. From a pure targeted traffic rely basis, it looked more like a regular Saturday just after Thanksgiving instead than a Black Friday. There’s no way to gown that one particular up, besides that customers have been telling us for months that they did not intend to go into merchants on Black Friday. Here are a few of data from our pre-holiday break client study:

- 74% of buyers claimed that they commenced procuring right before Black Friday (43% by the finish of October)

- 54% of purchasers did not plan to shop on Black Friday Weekend this yr

- 67% of buyers anticipated to shop less in retail store than past year

- 80% of purchasers are leveraging purchase on-line, ship to dwelling

Since the numbers are large for early purchasers and the greater part of these surveyed explained that they ended up not likely to visit merchants, the actual traffic outcomes need to not occur as any shock. We have been expressing for a when that due to coronavirus issues, seasonal in-retail outlet targeted traffic by day would very likely flatten out, and that although in previous many years the Best 10 purchasing days would alongside one another total to just about half of overall seasonal in-retail store targeted visitors, that this 12 months the number would be nearer to a person-third. This usually means that the drop in Black Friday site visitors may possibly profit other, later dates before New Year’s.

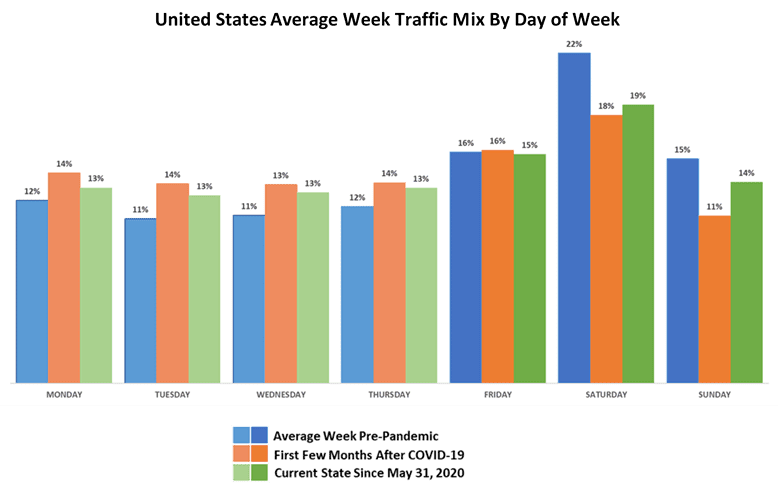

In advance of the COVID-19 outbreak, weekends in the United States accounted for around 53% of in-retail outlet traffic each and every week, with Saturdays at 22%. Considering the fact that the beginning of the summer time, people quantities have been trending to only 45%, with Saturdays at 19%. This shift by the consumer was intentional: they explained to us that they wished to locate significantly less crowded stores to assistance improved social distancing. All those two attributes are the opposite of what purchasers would hope from Black Friday Weekend. However, there are nonetheless five weeks to go right up until the close of the calendar year, and plenty of weekdays to get out and store in a related pattern to the 55% blend that have been searching on weekdays for pretty a when now.

Let us also consider a second to figure out that some of the Black Friday fall was intentional by stores, who modified their promoting strategies by extending promotions prior to and further than Black Friday by itself and encouraging shoppers to shop when they wanted to store and by way of what ever channel they felt most comfortable with. This was not only a socially accountable hard work by vendors, but it also took the force off shoppers needing to be early in line at brick-and-mortar shops for doorbusters, simply because there weren’t any.

The Relaxation of the Holiday break Season

The Black Friday Weekend kickoff to the 2020 holiday retail year was smooth from a website traffic perspective, but the rest of the period bears observing. If the weekday targeted visitors gains of the previous several months are an indicator, then we must keep on to see weekdays outperform weekends. The net influence will be a flattening of the site visitors curve, which in prior years was seriously weighted to the 3 or four Saturdays top up to Christmas Working day, additionally Christmas Week alone.

Talking of Christmas Week, two things may possibly intensify in-store shopper action as that week ways. Retailers are now warning customers to get out early to avoid shipping and delivery delays. As the cutoff to make certain holiday supply methods, consumers might choose that going to shops (no matter whether to store within or to pick up curbside) is their very best assure for present-offering. Moreover, if retailers choose to accelerate season-ending reductions, that could also drive in-retail store targeted visitors as we approach Xmas Day.

We nevertheless feel that at the close of the period, Black Friday will maintain its maintain as the best targeted traffic working day. There just won’t be as substantial of a gap involving it and the #2 working day, which is likely to be Super Saturday (December 19). If the leading times flatten out in comparison to the rest of the season, we could nevertheless see quantities equivalent to the place we ended up as the year started off — in the mid -20% vary. That is an remarkable turnaround when compared to the gap we have been in final April.

Brian Industry is the Senior Director of International Retail Consulting at Sensormatic Methods, the place he oversees the software of their proprietary traffic insights methods to retailer-distinct concerns across diverse functional parts in order to drive prime and bottom line keep efficiency. Prior to joining Sensormatic, Field served in roles of rising accountability at Chico’s FAS Inc., like as the Director of Corporate Shop Operations and Finance. Area has expended almost 4 many years in the field, and his knowledge incorporates: retailer revenue and administration, training, merchandising, strategic setting up and evaluation for makes as diverse as David’s Bridal, Circuit Town and Macy’s.